Understanding the Power of Money 6x REIT Holdings

The idea of Money 6x is about increasing your investment returns six times by making strategic investment decisions. One of the most successful methods to accomplish this goal is through investing in Real Estate Investment Trusts (REITs). REITs are firms that possess, manage, or fund real estate properties that generate income. They provide investors with a special chance to participate in real estate markets without having to buy properties directly.

Benefits of Investing in REITs(Real Estate Investment Trusts):

Investing in REITs helps diversify your portfolio and lower risk by spreading investments across various real estate sectors.

Access to the Real Estate Market is made simpler with REITs, offering a cost-effective opportunity to invest in sizeable real estate ventures. This availability allows smaller investors to take part in important real estate projects.

Real Estate Investment Trusts provide a great opportunity for investors to reach the Money 6x objective because of their setup and potential for profits. It is mandatory for them to give shareholders a minimum of 90% of their taxable income in dividends according to the law. This single trait makes REITs an attractive investment for individuals looking for steady earnings and growth in the value of their investments in the long run.

Stocks Vs REITs:

Understanding the basic distinctions and similarities is crucial when comparing stocks and REITs as investments.

Comparison of Stocks and REITs:

Investment Mechanisms: Stocks are ownership in companies, while REITs are ownership in real estate portfolios managed by professionals. Stocks provide ownership in a range of industries, while REITs specialize in investing in real estate assets.

Stocks mainly provide capital appreciation, whereas REITs offer both capital appreciation and generous dividend payouts. Stock prices are subject to fluctuations and are frequently impacted by market movements, company profits, and overall economic factors.

Pros and Cons of Each Investment:

Stocks:

Advantages: Possibility of achieving substantial increase in capital value. Historically, stocks have offered substantial returns over the long run, which appeals to investors seeking growth opportunities.

Drawbacks: Increased unpredictability and exposure to market uncertainties. Stock prices have the potential to vary greatly, and individual companies may encounter particular risks that affect how they perform.

REITs:

Real Estate Investment Trusts are types of financial instruments that allow investors to pool their funds in order to invest in a portfolio of real estate assets.

Advantages: Consistent earnings and reduced risk. REITs are recognized for their consistent dividend distributions and typically exhibit lower price volatility in comparison to single stocks.

Downside: Vulnerable to changes in interest rates. Increasing interest rates may have an effect on REITs by raising the costs of borrowing and causing their dividend yields to become less appealing compared to other income-generating investments.

Why REITs Are Attractive

REITs offer multiple appealing characteristics that can enhance the value of an investment portfolio targeting Money 6x returns.

Elevated dividend yields:

REITs need to distribute 90% of their taxable income as dividends, giving investors steady and appealing dividend yields. This large payout ratio guarantees that investors get a substantial share of the income coming from the real estate assets.

Reliable sources of income:

REITs provide stable income streams because of their extended lease contracts and consistent real estate demand. Reliable dividend payments are supported by the consistent rental income received from commercial properties, apartments, and other real estate assets.

Protection against inflation.

Real estate properties have a tendency to increase in value as time goes on, serving as a protection against inflation and maintaining buying power. With the rise in property values, the rental income also increases, leading to greater dividends for investors in REITs. This trait helps REITs effectively guard against inflation’s negative impact on investment profits.

Factors that lead to a 6-fold increase in returns on Real Estate Investment Trusts.

There are many factors that play a role in achieving six times the returns on investments in REITs. Having knowledge of these factors can assist investors in making wise decisions and optimizing their portfolios to achieve the highest possible returns.

Market Conditions:

The increase in economic activity enhances the value of real estate and rental earnings. Reduced interest rates can boost REIT performance by cutting down on borrowing expenses. When the economy grows, there is typically higher demand for commercial and residential properties, which causes property values and rental rates to rise.

Quality of management:

Skilled and knowledgeable management teams play a key role in maximizing property performance and investment gains. Being able to recognize profitable investment chances, handle properties effectively, and overcome market hurdles can greatly influence the success of a REIT.

Choosing the right property and its location are crucial decisions.

Locations that are prime and properties that are high-quality usually result in higher returns. Real estate investment trusts that invest in these assets are more inclined to attain greater returns. Real estate in economically thriving areas with high demand tends to increase in worth and produce steady rental earnings.

Techniques to Access Potential Six Times Greater

In order to secure a 6x return on investment with REITs, investors must utilize strategic approaches that enhance their potential earnings.

Extended Period for Investing:

Keeping REIT investments for an extended period enables the growth of capital and continuous reinvestment of dividends. Typically, real estate is an investment that spans over a significant period of time, and there can be significant advantages to holding onto REITs for a prolonged duration.

Investing profits back into an asset to generate future growth:

Reinvesting dividends has the potential to greatly increase earnings by utilizing the benefits of compound interest. Investors can increase their returns over time by reinvesting dividend payouts into more shares of REITs. This tactic uses profits reinvestment to create more revenue and expansion.

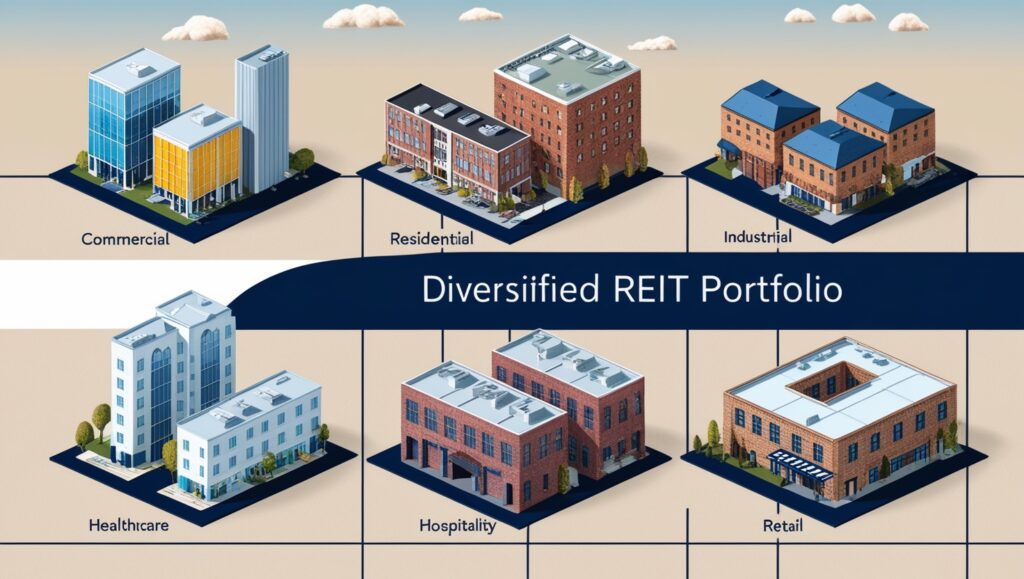

Spreading investments across different sectors of REITs.

Diversifying investments across different REIT sectors like retail, residential, commercial, and industrial helps lower risk and increase potential returns. Every industry has its own specific characteristics and potential hazards, so spreading investments across various industries can mitigate these risks.

The Role of Passive Income in Multiplying Your Money

Passive income is crucial for attaining financial success and effectively utilizing the Money 6x strategy.

Comprehending Passive Income:

Passive income is revenue generated with little active participation, offering financial security and independence. This source of income enables investors to earn money without ongoing exertion, making it an appealing part of a varied investment portfolio.

Real Estate Investment Trusts (REITs) provide a way to earn passive income.

Real Estate Investment Trusts (REITs) provide a stable source of passive income from dividends, making them an appealing option for investors looking for consistent revenue. The reliable dividend payments from REITs offer a steady income stream, especially useful for retirees or individuals aiming for financial freedom.

Generating wealth by earning money without actively participating, by Passive Income.

Putting passive income from REITs back into more REIT shares or other investments can speed up the growth of wealth. Investors can take advantage of the compounding effect by reinvesting dividends regularly, leading to their returns generating more returns as time goes on.

Reducing Risk in Your Real Estate Investment Trust Portfolio

Although REITs have the potential for high returns, it is crucial to effectively control risks in order to safeguard your investment.

Identifying Potential Risks:

Volatility in the market: Downturns in the economy can affect the values of real estate and the performance of REITs. Changes in the overall economy may impact the need for real estate, rental prices, and property worth.

Changes in interest rates: Higher interest rates can lead to higher costs of borrowing and impact the profitability of REITs. Increased interest rates may cause REITs to incur higher financing expenses, resulting in less appealing dividend yields compared to alternative income-producing investments.

Risk Management Techniques:

Diversifying: Allocating investments into various sectors and locations of REITs can assist in reducing risk. Investors can lower their vulnerability to particular market or sector risks by spreading out their investments.

Selecting REITs with skilled leaders and top-notch properties is essential. REITs led by skilled and experienced management are better equipped to handle market obstacles and provide steady returns.

Monitoring and Adjusting Your Portfolio:

Diversification: Allocating investments among various REIT sectors and geographic areas can reduce risk. Investors can lower their vulnerability to particular market or sector risks by spreading out their investments.

Careful selection is important when picking REITs with robust management teams and top-notch assets. REITs led by skilled and experienced management are better equipped to handle market obstacles and provide stable returns.

Watching and making changes to your investment holdings:

Consistently evaluating and making changes to your REIT portfolio according to market conditions and performance metrics is essential for maximizing returns. Being up-to-date on economic trends, interest rate changes, and real estate market news can assist investors in making timely changes to their investment portfolios.

Summary of the 6x REIT Formula

Summary of Important Tactics:

Make long-term investments.

Invest your dividends back into the company.

Spread investments across different types of Real Estate Investment Trust sectors.

Practical Tips for Investors:

Begin with a defined plan for investing.

Emphasize on high-quality REITs that have excellent management.

Frequently assess and make changes to your investment collection.

Encouragement to Begin Investing:

By utilizing Money 6x REITs effectively, you can greatly boost your financial prosperity. Begin today and embark on the first move towards reaching your investment objectives.

By sticking to these methods and adopting a disciplined investment strategy, you can utilize Money 6x REITs to attain remarkable financial achievements.

Read Our Case Study On the famous Stanley cup: CLICK HERE

FAQ

- What is Money 6x?

Money 6x is a concept that involves multiplying your investment returns sixfold through strategic investment choices, such as investing in REITs.

- How do REITs provide high dividend yields?

REITs are required to distribute at least 90% of their taxable income as dividends, resulting in high and consistent dividend payouts for investors.

- What are the main benefits of investing in REITs?

Benefits include diversification, access to real estate markets, high dividend yields, stable income streams, and protection against inflation.

- How does reinvesting dividends help in achieving Money 6x returns?

Reinvesting dividends boosts returns through the power of compounding, where reinvested earnings generate additional income over time.

- What risks should I be aware of when investing in REITs?

Potential risks include market volatility, economic downturns, and interest rate changes that can impact REIT performance and profitability.

- How can I mitigate risks in my REIT portfolio?

Mitigate risks by diversifying investments across different REIT sectors, choosing REITs with strong management, and regularly monitoring and adjusting your portfolio.

- Why are REITs considered a good source of passive income?

REITs generate steady passive income through regular dividend payments, providing a reliable income stream for investors.

- What factors drive sixfold returns on REIT investments?

Factors include favorable market conditions, quality management teams, and prime property selection and location.

- What is the importance of a long-term investment horizon in achieving Money 6x returns?

A long-term investment horizon allows for capital appreciation and the compounding of dividends, enhancing overall returns.

- How can I start investing in REITs to leverage Money 6x for financial success?

Begin by developing a clear investment strategy, focusing on high-quality REITs, and consistently reviewing and adjusting your portfolio based on market conditions.

If you want to learn more about psychology of money Click Here to Read the best book.

Leave a Reply